Letter to Government Officials (Copied to Local Media)

In light of the recent hardship-inducing car insurance premium increases across Clark County, I am writing to call for greater oversight of the insurance industry as a whole (see Insurance Industry Oversight Recommendations below), as well as for any insight and assistance you can provide. I cannot comprehend how, in a quasi-regulated environment, rates are allowed to increase this much for anyone, much less someone with my ‘credentials’, especially without notice or full transparency as to the cause.

Background/Premium Concerns

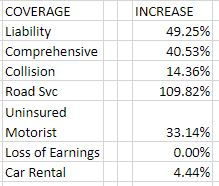

I have lived in Nevada for over 30 years, been insured with State Farm for 42 years, and been surprised by an increased car insurance premium a few times, but nothing like the most recent one. Since I bought my car in October 2018, my 6-month premium has decreased 5 times (generally 1-5%) and increased 5 times (generally 2-3%), yet the current premium is an exorbitant 36% increase from six months ago and a 21.6% increase over the premium billing just prior to COVID. I actually gasped out loud when I looked at the amount due, especially given that:

- My car will be 5 years old in October, and yet the amount due is considerably higher than any prior six-month period.

- I drive this car approximately 1000 miles a year, and it is in my garage the rest of the time.

- I had one claim last year (2022) in March for roadside assistance because my battery was dead.

- I have not been involved in an accident for many years and have never been at fault or received any points on my license.

- The billed amount includes several discounts (accident-free, annual mileage, multi-line, vehicle safety).

- My credit score is in the excellent range (and has been for most of my life).

Other insurers wanted even more. Bottom line, I am shocked at the increases and beyond disappointed with the handling of them.

Transparency Concerns

The lack of transparency on the part of insurers and government offices regarding the car insurance premium increases is an equally worrisome issue. It seems like people are getting different answers depending on who (and how often) they ask. One ‘rationale’ quickly transforms into another as soon as you dismiss it as invalid.

- Credit Scores: The first answer I got from State Farm was that it was because they could no longer consider credit scores in determining premiums. They forwarded the COVID Emergency Declaration regulation to me, indicating it went into effect in August 2023. The legislation actually went into effect in early 2020, was temporary (through May 2024 it appears), and only requires that insurers not increase a premium based on a change in credit score (all irrelevant to my situation). Beyond that, the 2023 Division of Insurance Market Report referenced that some insurers in the state currently use credit-based scoring, which implies it is legal to do so.

- Outdated Press Coverage: When I asked my State Farm office again (noting these details), I was told that increases had been anticipated and received two articles from January/February 2023 (which I had already reviewed during my research). These articles indicated increases of 8% to 9% and, as such, gave me no insight into the current increases of 35% to 70%. I could find nothing more recent (nor could they apparently; in all fairness, my agent’s office seemed kind of blindsided by the rate increases as well).

- Economic Issues: As I researched, I discovered this was a wide-ranging problem, with considerable hardship impacts beyond my own. The responses others were getting from the Nevada Division of Insurance (directly or via the Governor’s Office) related to increasing medical and repair costs combined with supply chain and labor issues, uninsured motorists, fraud, and increases in driving.

- Most of these things have been an issue for at least a few years now so nothing here explains the sudden exorbitant increases. The supply chain and labor have been issues since 2020, so again, there is no explanation for the huge increase in August 2023. Inflation has also been nowhere near the 35% to 70% increases in premiums. Even if these factors are having an impact, passing through full anticipated costs (i.e, making citizens pay for problems related to the economy instead of taking action on issues that should be addressed by businesses and government) is unjust and discriminatory.

- And it’s an open question on increases in driving – Since when? Lockdown? I highly doubt there’s an increase from pre-pandemic times, when rates were much lower.

Overall, the generic causes listed sound as if they were pulled directly from the January/February articles State Farm provided me, so again, no relevant insight.

Equity & Sustainability Concerns

- Zip Code: Upon further questioning, the Governor’s Office told at least one citizen the car insurance premium increase was due to their residential zip code. Zip code risk has also been factored into premiums for a long time, so again this does not seem like a transparent response. I find it hard to believe that vehicle thefts are incredibly higher in low-income zip codes when they’re happening all over town. And in our very mobile society, the risk has little to do with where a vehicle is registered when it might spend the vast majority of time in a different zip code and even be garaged in its home zip code.

- There are all kinds of equity issues here as well. The way utilities, rents, and other necessary expenses have increased in Clark County, people often live the only place they can afford, with options sorely limited by the dearth of affordable housing. And then, as a result of where they live, they can be charged more for other things because it’s considered a higher risk zip code? How can anyone get ahead (or even survive) in this scenario?

- Uninsured Motorists: The number of uninsured motorists is often cited as the primary reason for high insurance premiums in Nevada. The problem with raising rates on that basis is that it creates a never-ending, no-win cycle. The more unaffordable premiums are, the more people who are uninsured. The more people who are uninsured, the more rates increase, and, as a result, the more people who cannot afford insurance. And let’s be honest, you can’t expect people who are struggling to get by to just stop driving when they have no other way to reliably make it to their jobs on time and can by no means afford to lose their job. Instead, they are basically forced to risk fines they also cannot afford.

- When inflation is already hitting many people hard (skyrocketing energy, fuel, and food costs; the lack of affordable housing), an increase of this size can be a breaking point. More and more people in Southern Nevada are being pushed to the brink with every day that goes by. I see (and feel) the fear and anxiety every day from fellow residents online and off. I myself am currently unemployed and carefully budgeting to live on my savings; this type of unexpected expense is really a hardship. In general, it seems like a death spiral to say that Nevada has high rates because there are so many uninsured drivers and then blindside insureds with a huge increase which will render more people unable to pay. If that continues, only a handful of people will be able to afford it at all.

Given how most of these ‘proposed causes‘ have existed for at least a few years and are allegedly easing at this point, it seems like there must be something else that is not being disclosed to explain sudden rate increases of 35%+ for a huge number of people. There have certainly been worse economic times in the 40+ years I’ve been driving, but there have NEVER been car insurance premium increases like these! And we, the taxpayers, deserve a proper, logical, and legitimate explanation if not financial relief.

Other Possible Justifications?

- Theft by Class: At first I thought that perhaps drivers of similar car classes were being made to cover the Kia/Hyundai theft losses. That would seem grossly inappropriate, but it would at least be an explanation that was timely. After finding out that drivers of all types of vehicles had seen these kinds of increases, I realized it must be something more universal.

- ‘Gentlemen’s Agreement’: After more research, I began wondering if insurers held off on increases until the Federal COVID Emergency Declaration was rescinded and are staying mum as a result. Perhaps there was a ‘gentlemen’s agreement’ between the government and the major insurers to hold off and then take an extra bump as an incentive? Are the increases perhaps quid pro quo for some major campaign contributions from the insurers? Or is there something else going on under the surface?

I understand that costs are going up and utilities and insurers must cover their costs, but, even with all the inflationary increases that have occurred in rent, food, gas, and utilities over the last year, none of my bills have increased by anywhere close to 36% from one billing period to the next or over six months. If any of the ‘justifications’ for car insurance premium increases outlined above are valid, it would likely have been far more palatable and humane for rates to increase gradually, as the conditions did not suddenly worsen significantly overnight.

Advance notice should be required at the very least, as it is for rent and utility increases. Opening a bill this month to find an exorbitant increase you are totally unprepared for (and perhaps unlikely to afford as a result) leaves you feeling like you’ve been punched in the gut one more time. At least with utilities there are at least hardship programs to ensure basic services and a Public Utilities Commission to offer some oversight and restraint. When it comes to vehicle insurance and fuel, there is no such help.

Insurance Industry Oversight Recommendations

Why don’t insurers put more effort into the customer experience? Because they don’t have to. Law-abiding citizens are at their mercy, and the State does nothing to help ensure we don’t bear that extra weight. It’s time for that to change. These kinds of car insurance premium increases, along with other insurer practices, seem to beg for greater oversight of the insurance industry as a whole.

What would it take to put some protective measures in place? Here are just a few ideas that quickly come to mind:

- Limiting the percentage increases allowed over a six-month or annual premium billing period (with vs. without cause on the insured’s part).

- Requiring advance (i.e., 60-day) notice (direct and public, as with utilities) of significant premium increases, including full disclosure to justify increases over five percent in any given billing period.

- Requiring insurers to include contact information for where complaints can be sent (legislators, governor, insurance commission, etc.) to increase accountability and trustworthiness.

- Creating an uninsured motorist fund, potentially supported by insurer contributions and/or government funding, since it should be the State’s responsibility to ensure people driving in the state have the required coverage. It is an undue burden for law-abiding citizens to carry, especially when it is a downward spiral into the abyss where only the rich will be able to afford insurance.

- Creating an oversight commission (like the PUC for utilities) that reviews, questions, and approves/denies increases and ensures there is a means for basic coverage in hardship situations, to minimize the uninsured motorist issue and the risk for those with low incomes trying to comply.

- Providing oversight of discount structures with regard to inequity, redundancy, and ‘pay for play’. Insurance companies have a tendency to implement things that benefit them while disguising them as benefits for insureds, which lacks transparency and may even qualify as fraudulent, while also driving further inequity.

- Defensive Driving Discounts: What’s the point of having a good driving record if you need to take the same class as ‘significant offenders’ AND pay up to $35 for the privilege, in order to qualify for a $26 discount for a 6-month period? I believe the only ‘collision’ claims I’ve had in my 30 years in Las Vegas have all occurred while I was either parked in a parking lot or stopped at a light (nothing a defensive driving course would remedy). It seems to me a perfect (or near perfect) record already speaks to defensive driving skills, so paying for a class to learn what you already know seems to serve no valid purpose, unless perhaps the insurers are making bank off the programs being offered. The record alone should be enough to earn the discount.

- Beacon/Tracking Discount: It seems like this option (e.g., Drive Safe and Save from State Farm) is discriminatory, given that a certain segment of the population is not comfortable with or does not have access to the required technology or finds this type of practice an invasion of privacy. Frankly, it seems to me the only benefit to these devices is for insurers to have data to use against insureds and/or deny claims. Again, an excellent driving record and an odometer reading speak for themselves and should be adequate to qualify for the discount.

Beyond the discount recommendations already made, it seems there might be additional ways to guide how risk assessment and premium determination are enacted to ensure greater equity, especially with all the data available today. For example:

- More annual mileage tiers for people who drive rarely or extensively, to better align with risk.

- Consideration of continuous coverage in premium calculation (or a discount in lieu), to encourage drivers to maintain coverage and to reward them for doing so, making it more affordable to continue.

- Consideration of long-term driving history in premium calculation (or a discount in lieu), to better align risks and rewards with real exposure rather than requiring redundant courses and/or tracking.

- Consideration of how exposed the vehicle is to risk of theft or collision, e.g., garaged vs. not, where/how long it regularly is parked and driven, security in place, etc. (or a discount in lieu).

So firstly, I implore you, get to the bottom of this car insurance premium increase and be fully transparent about the rationale and the timing. The truth can’t make it any uglier than it already is for those of us who have been blindsided. Then, put in place some protective regulation for the insureds (your fellow citizens and constituents).